2022 annual gift tax exclusion amount

For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000. The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

For 2022 the annual exclusion is 16000 per person up from 15000 in 2021.

. 2022 Annual Gift Tax and Estate Tax Exclusions Increase. That means you can give up to 16000 to as many recipients as you want without having to pay any gift tax. The annual exclusion for 2014 2015 2016 and 2017 is 14000.

The estate and gift tax lifetime exemption amount is projected to increase to 12060000 currently 11700000 per individual. As of November 10th the IRS has issued guidance for 2022. In 2022 this.

According to the Wolters Kluwer projections in 2022 the gift tax annual exclusion amount will increase to 16000 currently 15000 per donee. This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021 httpswwwirsgovnewsroomirs-provides-tax-inflation-adjustments-for-tax-year-2022.

Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. What per person per person means. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS.

The new numbers essentially mean that wealthy taxpayers can transfer more to. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and. The gift tax annual exclusion amount per donee has increased to 16000 for gifts made by an individual and 32000 for gifts made by.

The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. You can give this much to an unlimited number of people each calendar year totaling any amount of money tax-free without using any of your unified gift and. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

The federal estate tax exclusion is also climbing to more than 12 million per individual. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022. In 2022 the gift tax annual exclusion increased to 16000 per recipient.

Gifts of less than the annual gift exclusion are passed on tax-free while gifts over the exemption amount could be subject to the unified gift and estate tax. In addition the basic estate tax exclusion amount for the estates of decedents dying during calendar year 2022 will be 12060000 for individuals and. You could give any individual up to 15000 in 2021 without.

And the gift tax annual exclusion amount jumps to 16000 for 2022 up from 15000 where its been stuck since 2018. If the gifts are made via trust the trust must be written to include a Crummey withdrawal power to qualify as a present interest gift for the annual exclusion. The New York basic exclusion amount will also increase in 2022 from 593 million to 611 million.

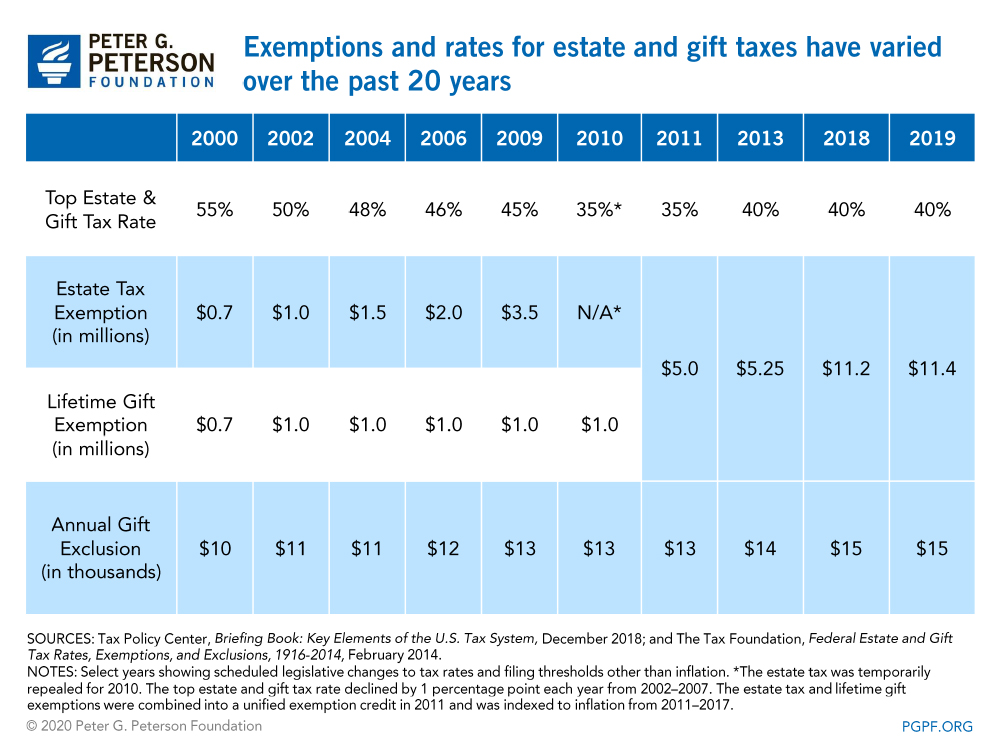

13 rows Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. This is of particular interest to families with special needs because the ABLE contribution cap is tied to the annual gift tax exclusion meaning that the.

The Gift Tax Annual Exclusion increased by 1000 in 2022. The gift exclusion applies to each person an individual gives a gift to. 27 rows How the Annual Exclusion Works.

The federal estate tax exclusion is also climbing to. The annual exclusion applies to gifts to each donee. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

How gift tax is calculated and how the annual gift tax exclusion works In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. If you and your spouse want to gift something that. For 2022 the annual gift exclusion is being increased to 16000.

The annual gift exclusion is applied to each donee. For 2018 2019 2020 and 2021 the annual exclusion is. The Connecticut estate and gift tax applicable exclusion amount will increase from 71 million to 91 million in 2022.

It was 15000 per person for 2018 through 2021 but it has been raised to 16000 this year. The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. What is the gift tax annual exclusion amount for 2022.

This amount remains scheduled to meet the federal estate and gift tax exclusion amount in 2023. Outright gifts to recipients qualify for the annual exclusion. In addition to the multimillion-dollar exclusion there is also an annual per person exclusion.

Any person who gives away. ANNUAL GIFT TAX EXCLUSION.

Gift Tax Exclusion For Tuition Frank Financial Aid

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Gift Tax Explained 2021 Exemption And Rates

What Are Estate And Gift Taxes And How Do They Work

Gift Tax Limit 2022 What Is It And Who Can Benefit Marca

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

You Can Stretch The Gift Tax Limit By Paying For Education Or Health Care

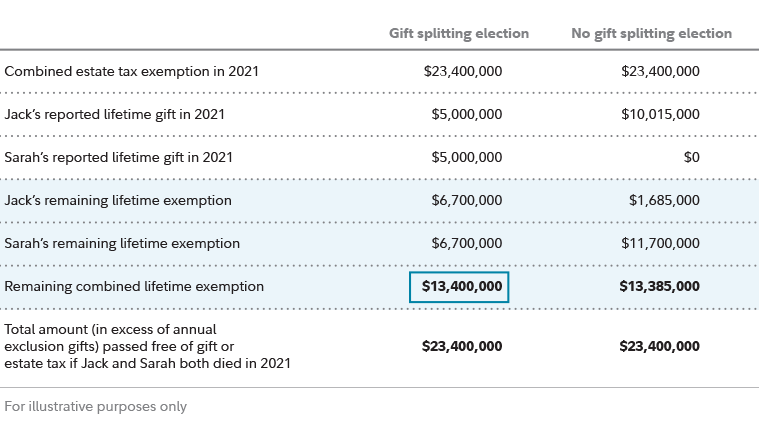

Estate Planning Strategies For Gift Splitting Fidelity

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The Annual Gift Tax Exclusion H R Block

2020 Estate Planning Update Helsell Fetterman

How Much Money Can You Gift Tax Free The Motley Fool

2022 Changes To Estate And Gift Tax Exclusions Cole Schotz Jdsupra

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax And Other Exclusions Increases For 2022 Henry Horne